SOMA Token (Reg CF)

Introduction

SOMA Token Advantages

Dividends

Token holders will be eligible to receive a portion of SOMA.finance's profits in the form of preferred dividends.

Staking

Earn passive income by putting your tokens into a staking pool - a simple and secure way to earn rewards on your SOMA tokens.

Yield Farming Opportunities

Earn additional SOMA tokens and stablecoin rewards through SOMA token yield farming pools and initiatives.

Corporate Ownership

SOMA token holders have the rights of ownership of an actual security interest in SOMA Finance Incorporated in the form of a preferred equity position.

Market overview

Total DeFi users as of Nov 2024

8.54

Million

users

DEX Trading volume as of Nov 2024

1.2

Trillion

USD

Tokenized Securities Market Cap as of Nov 2024

176

Billion

USD

Tokenized Securities Market Growth in 2024

226%

Total equity issuance

28.8

Billion

USD

Market gaps

Regulatory challenges and lack of licensing

Exposure to bad actors and market manipulators

Inaccessibility to specific securities and asset classes

Fragmented access to DeFi products and offerings

Lack of transparency and regulatory oversight

Absence of platform security and user protection

Solutions

First mover in compliance

Through Tritaurian Capital, SOMA.finance currently has the only SEC & FINRA approved license to offer tokenized securities on any blockchain.

Multi-asset platform

SOMA.finance will initially launch with 10-20 tokenized equities, ETFs, crypto assets, and STOs with more products to be added.

P2P AMM Transaction

Trade across all asset classes in a peer-to-peer and decentralized fashion, without having a centralized orderbook or there being room for market manipulation.

Semi-permissionless access to DeFi

Following the proper KYC/AML guidelines, institutions and retail alike will be able to access yield farming and liquidity provider incentives, as well as a number of DeFi primitives.

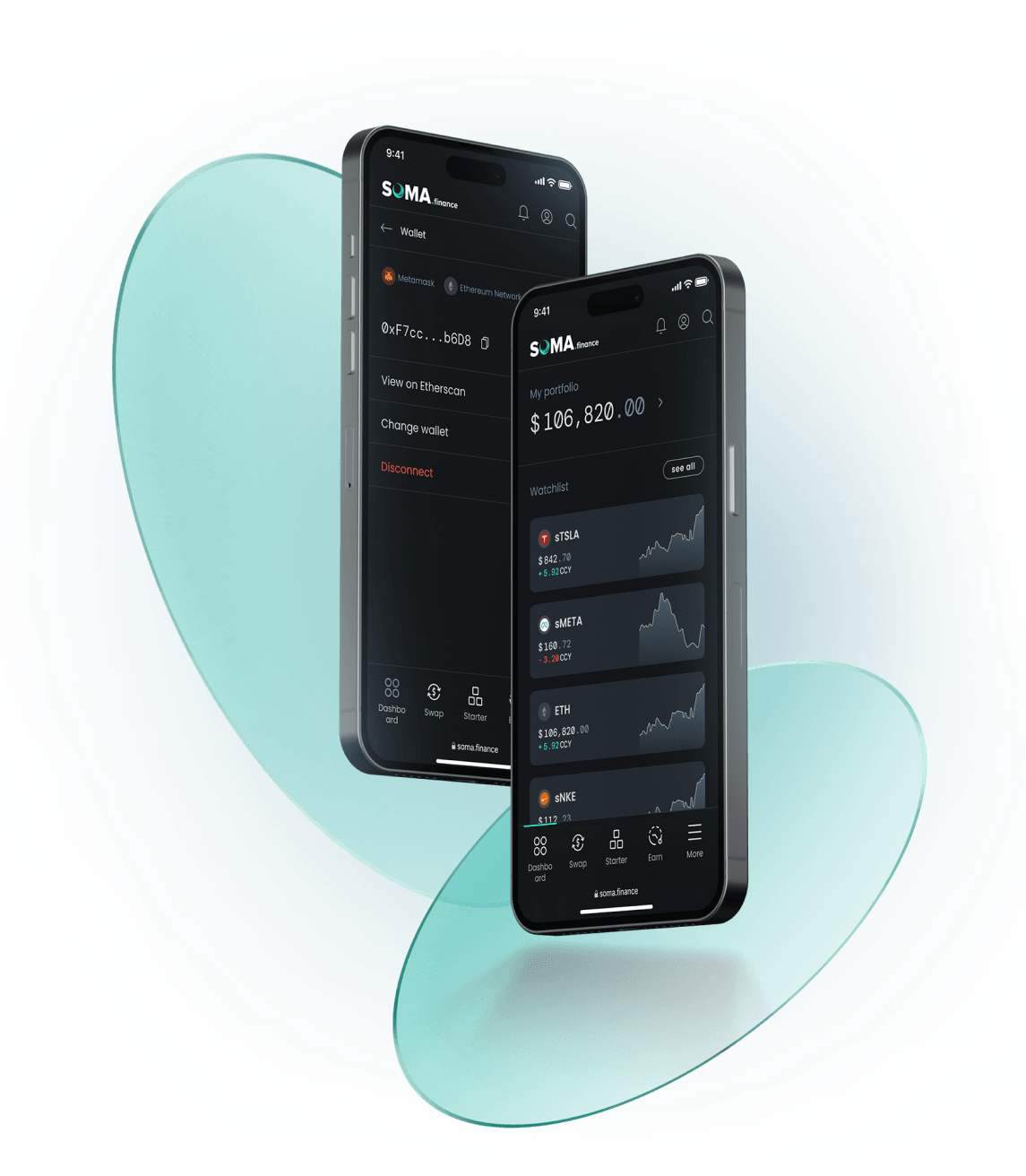

Product overview

Traction

- Large database of signed up users.

- High engagement rates for social media and emails.

- Successfully executed RegD offering for Spencer Dinwiddie's NBA contract tokenization deal.

- Closed seed round and liquidity round raising $13 million USD from top global investors (see notable investors).

Vision and strategy

To offer a secure bridge between DeFi and TradFi for anyone, anywhere in the world.

Innovation

We deliberately and persistently innovate, bringing new ideas and possibilities to finance.

Integrity

In an industry oftentimes characterized by predation, integrity keeps us accountable to end users all over the world.

Adaptability

DeFi is in constant motion and always evolving. We are committed to staying ahead of the curve by understanding user needs and adapting to meet them.

Empowerment & education

To empower investors around the world, we educate, understanding that our ideal user is an informed one.

Roadmap

Phase 1: Pre-launch

Phase 2: Post-launch

$SOMA tokenomics

Total supply

88,888,888 SOMA

$SOMA vesting schedule

Team members

William Heyn

Co-Founder & CEO

Will Corkin

Co-Founder & COO

James Preissler

Co-Founder

John Patrick Mullin

Co-Founder

Rodrigo Miranda

Co-Founder

Notable investors